The Chinese Oil and Gas Market is segmented by Sector (Upstream, Midstream, Downstream).

| Study Period: | 2019-2027 |

| Base Year: | 2021 |

| CAGR: | >2 % |

Market Overview

The Chinese oil and gas market is expected to register a CAGR of more than 5% during the forecast period, 2022-2027. The COVID-19 outbreak in Q1 2020 had an adverse impact on the Chinese oil and gas market in terms of drawdown investments, shortage of import quotas, and further muted Chinese fuel consumption. Factors such as the discovery of new oil and gas fields, rising oil and gas investments, and the growing demand for energy with the rising population are expected to drive the oil and gas market during the forecast period. However, the growing demand for renewable energy is expected to hinder the market’s growth during the forecast period.

- The midstream segment is expected to witness significant growth in the Chinese oil and gas market during the forecast period.

- China targets to boost domestic production of unconventional sources like shale gas. It is also estimated that China’s shale gas production may reach around 280 billion cubic meters (bcm) by 2035. Thus, the plans to boost its shale gas production are expected to create an opportunity in the coming years.

- The rising oil and gas investments, especially in the upstream and midstream sectors, are expected to drive the nation’s oil and gas market during the forecast period.

Scope of the Report

The Chinese oil and gas market report includes:

Report scope can be customized per your requirements. Click here.

Key Market Trends

Midstream Sector to Witness Significant Growth

- China’s oil and gas midstream consists of oil and gas pipelines and storage facilities. As of 2021, the country has nearly 110,000 kilometers of natural gas pipeline, while the oil pipeline of nearly 27,441 kilometers.

- In April 2020, China’s Sinopec started building storage tanks in the second phase of its Tianjin terminal project to receive liquefied natural gas (LNG). The plan for the second phase is to have five LNG tanks with a storage capacity of 220,000 cubic meters each and a new berth for LNG vessels.

- In July 2020, PipeChina agreed to buy pipelines and storage facilities valued at USD 55.9 billion. Under the deal, PipeChina, known formally as China Oil and Gas Pipeline Network, will take over oil and gas pipelines and storage facilities from state-owned energy giants PetroChina and Sinopec in return for cash and equity in the pipeline company.

- Moreover, China has nearly 287 storage facilities with approximately 1.06 billion barrels of total storage capacity (crude oil: 74 facilities with 706.1 million barrels of capacity; refined products: 213 facilities with 357 million barrels of capacity).

- In October 2021, China Petroleum & Chemical Corp (Sinopec) commenced operations on a 10 billion cubic meter Wei 11 gas storage facility in Northern China. The Wei 11 gas storage facility built in the Zhongyuan oilfield region has completed its first gas injection. The storage mainly covers the region of the middle and lower reaches of the Yellow River – Henan Province and East China’s Shandong Province.

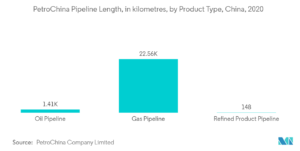

- PetroChina’s domestic crude oil pipelines had a total length of about 7,190 kilometers in 2020, while gas pipelines had a total length of about 22,555 kilometers. Overall, pipeline length decreased in 2020 compared to the previous year.

- With rising demand for natural gas, the country is planning to build 23 gas storage facilities by 2030, with an investment of around USD 8.5 billion. The completion of the storage facilities, along with the upcoming gas pipelines in the country, is expected to boost the midstream sector in the near future.

- Therefore, based on the above-mentioned factors, the midstream segment is expected to witness significant growth in the Chinese oil and gas market during the forecast period.